Discovering the Elegance and Durability of Teak Outdoor Furniture from Indonesia

Comments Off on Discovering the Elegance and Durability of Teak Outdoor Furniture from Indonesia

Teak outdoor furniture from Indonesia is renowned for its exceptional quality, durability, and timeless appeal.…

6 Signs That Your Toilet Needs a Replacement

Comments Off on 6 Signs That Your Toilet Needs a Replacement

Our toilets don’t always make a good table talk. Do you know why? They are…

How Epoxy Garage Floor Installers Can Transform Your Space

Comments Off on How Epoxy Garage Floor Installers Can Transform Your Space

The Appeal of Epoxy Flooring Epoxy floors have revolutionized residential garages from dusty, oil-stained areas…

How Regular Maintenance Can Prevent Costly Garage Door Repairs

Comments Off on How Regular Maintenance Can Prevent Costly Garage Door Repairs

The Value of Ongoing Garage Door Maintenance For many homeowners, a garage door is more…

The Homeowner’s Checklist for Preparing Your Air Conditioning System for Summer

Comments Off on The Homeowner’s Checklist for Preparing Your Air Conditioning System for Summer

Summer is the perfect time to relax, unwind, and enjoy the warm weather. However, it’s…

Unlocking Harmony: Mind-Body Connection Exercises for a Healthier You

Comments Off on Unlocking Harmony: Mind-Body Connection Exercises for a Healthier You

Have you ever marveled at the incredible synergy between your mind and body? The connection…

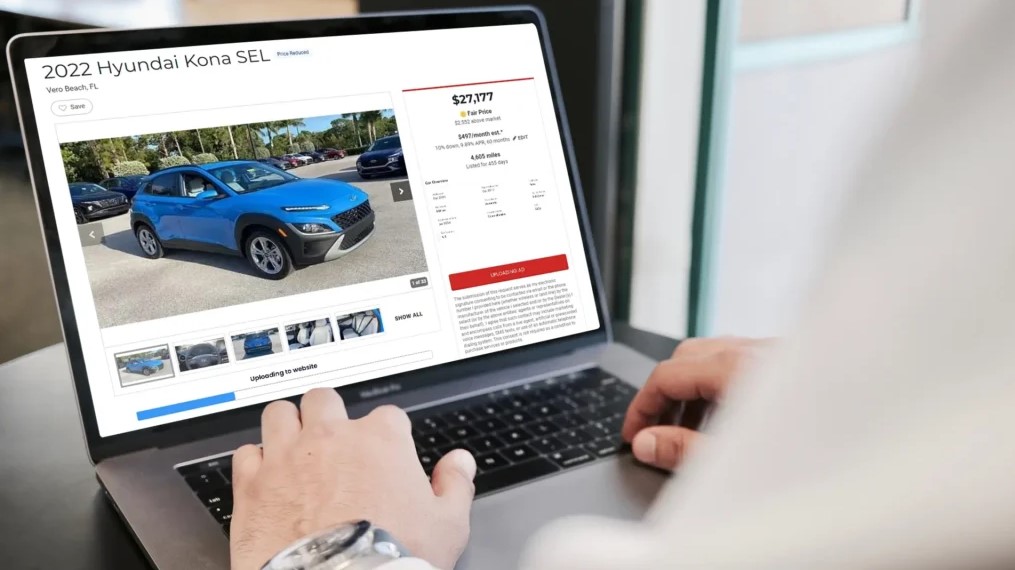

7 Tips to Sell Your House Fast in St. Petersburg, FL

Comments Off on 7 Tips to Sell Your House Fast in St. Petersburg, FL

There are many reasons why you may want to sell your St. Petersburg house. Not…

7 Key Advantages of Partnering with a Custom Machine Shop

Comments Off on 7 Key Advantages of Partnering with a Custom Machine Shop

The manufacturing landscape is ever-evolving, with technological advancements at its core. At this crossroads, a…

Recommended Products From Professional Dermatologists

Comments Off on Recommended Products From Professional Dermatologists

In the realm of skincare, nothing substitutes for professional advice. The best dermatologists not only…

5 Reasons To Hire Jan-Pro Commercial Cleaning Services

Comments Off on 5 Reasons To Hire Jan-Pro Commercial Cleaning Services

JAN-PRO Cleaning & Disinfecting provides commercial cleaning services Portland Oregon, to a variety of industries.…

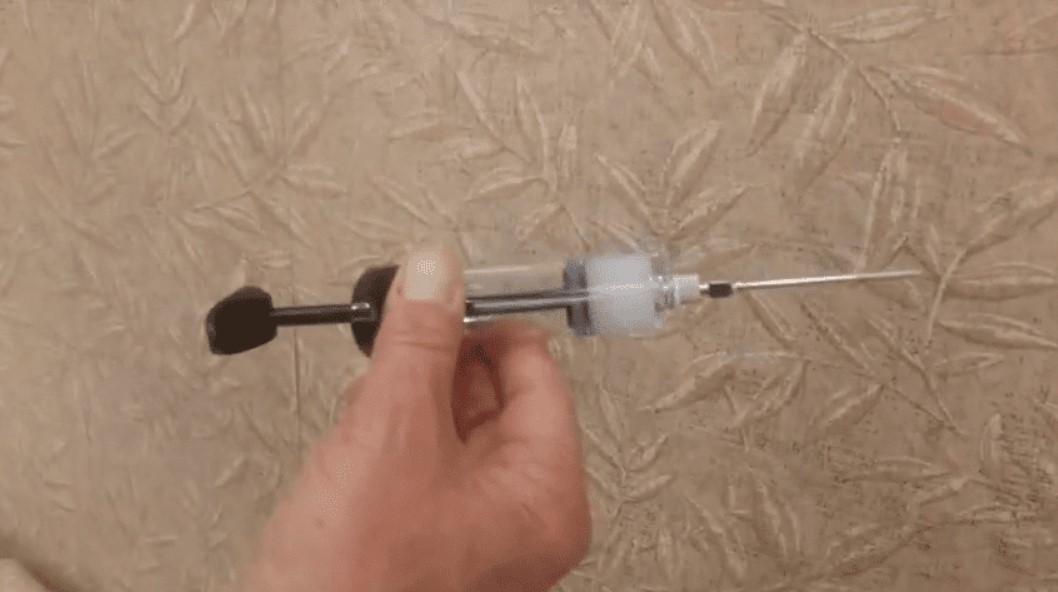

How To Remove Wallpaper Bubbles

Comments Off on How To Remove Wallpaper Bubbles

Introduction Are you experiencing bubbles in your wallpaper? Are bubbles spoiling the beauty of your…

5 Reasons Why You Should Prune Your Trees

Comments Off on 5 Reasons Why You Should Prune Your Trees

Trees provide numerous benefits, from increasing your property value to simply making your home and…

5 Benefits and Features of Hurricane Impact Windows and Doors

Comments Off on 5 Benefits and Features of Hurricane Impact Windows and Doors

Hurricane impact windows and doors take specialized design to provide superior protection against the damaging…

What Are the Environmental Benefits of Using Blast Booths for Surface Cleaning?

Comments Off on What Are the Environmental Benefits of Using Blast Booths for Surface Cleaning?

As industries continue to grow, there’s a need for effective and efficient surface cleaning methods.…

- 1

- 2

- 3

- …

- 784

- Next Page »